The Difference Between A Trailing Stop And A Fixed Stop

When you invest or trade in the financial markets, one of the most important things to consider is how you will manage risk. One common risk management technique is the use of stop orders, which allow you to automatically sell an asset if it reaches a certain price.

There are two main types of stop orders: fixed stops and trailing stops. Each one works in a slightly different way, and has its own advantages and disadvantages.

What is a Fixed Stop?

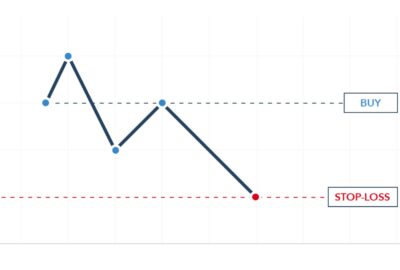

A fixed stop, also known as a fixed stop loss, is a type of stop order that is set at a specific price level. When the asset being traded reaches that price level, the stop order is triggered, and the asset is sold.

For example, if you buy a stock for $100 per share, you might set a fixed stop at $90 per share. If the stock falls to $90, your stop order is triggered, and the stock is sold.

How Does a Fixed Stop Work?

A fixed stop is designed to limit your losses in a trade. By setting a fixed stop at a certain price level, you know exactly how much money you stand to lose if the trade goes against you.

However, it’s important to note that a fixed stop does not guarantee that you will sell your asset at the exact price level you set. In fast-moving markets, the price of the asset may “slip” past your stop level, resulting in a larger loss than you anticipated.

Advantages and Disadvantages of a Fixed Stop

The main advantage of a fixed stop is that it provides a clear, predetermined exit point for your trade. This can help you stay disciplined and avoid emotional decision-making when the market is volatile.

A fixed stop also has some disadvantages. One is that it may result in missed opportunities if the asset rebounds after hitting your stop level. Additionally, if you set your stop too close to your entry price, you may be “stopped out” of the trade prematurely, before it has a chance to turn in your favor.

What is a Trailing Stop?

A trailing stop, also known as a trailing stop loss, is a type of stop order that is set at a certain percentage or dollar amount away from the current market price. As the price of the asset moves in your favor, the trailing stop “trails” it and adjusts itself automatically to maintain that set distance.

For example, if you buy a stock for $100 per share, you might set a trailing stop at 10% below the current market price. If the stock rises to $110 per share, your trailing stop would adjust to $99 per share. If the stock then rises to $120 per share, your trailing stop would adjust to $108 per share.

How Does a Trailing Stop Work?

A trailing stop is designed to lock in profits while allowing your position to continue to grow as long as the price is moving in your favor. It can help you stay in a trade longer and capture more gains than a fixed stop might allow.

However, it’s important to note that a trailing stop also has some risks. If the price of the asset suddenly drops, your trailing stop may be triggered at a much lower price than you anticipated, resulting in a larger loss than you would have had with a fixed stop.

Advantages and Disadvantages of a Trailing Stop

The main advantage of a trailing stop is that it allows you to capture more gains in a trade, while still limiting your losses. It can help you stay in a trade longer and avoid the temptation to sell too soon.

However, a trailing stop also has some disadvantages. One is that it can be more difficult to set up and manage than a fixed stop. Additionally, it may not be appropriate for all types of assets or market conditions.

Trailing Stop vs. Fixed Stop: Which One Should You Use?

The choice between a trailing stop and a fixed stop ultimately depends on your trading style, risk tolerance, and the specific asset you’re trading. In general, a trailing stop may be more appropriate for longer-term positions or assets with higher volatility, while a fixed stop may be more appropriate for shorter-term positions or assets with lower volatility.

Examples of When to Use a Trailing Stop

Here are a few examples of when a trailing stop might be appropriate:

- If you’re holding a stock that has been steadily increasing in price and you want to lock in some profits while still allowing the stock to continue to grow.

- If you’re holding a cryptocurrency that is known for its high volatility and you want to limit your losses if the price suddenly drops.

Examples of When to Use a Fixed Stop

Here are a few examples of when a fixed stop might be appropriate:

- If you’re day trading a stock and want to limit your losses if the trade goes against you.

- If you’re holding a bond that is expected to pay a fixed rate of return and you want to lock in a certain level of profit.

Tips for Using Trailing Stops and Fixed Stops Effectively

Here are a few tips for using both trailing stops and fixed stops effectively:

- Set your stop level at a reasonable distance from the current market price, taking into account the volatility of the asset and your own risk tolerance.

- Regularly monitor your trades and adjust your stop levels if necessary.

- Don’t rely solely on stop orders to manage risk. Consider using other risk management techniques, such as diversification and position sizing.

- Consider backtesting your trading strategy to see how it would have performed in the past with different types of stop orders.