How To Use MACD In Trading

If you’re a trader or investor, you’re probably always looking for ways to improve your strategy and increase your profits. One tool that can be incredibly useful in your trading arsenal is the Moving Average Convergence Divergence (MACD) indicator. In this article, we’ll take a closer look at what MACD is, how it works, and how you can use it to make better trading decisions.

What is MACD?

MACD is a technical analysis indicator that was developed by Gerald Appel in the late 1970s. It is designed to show changes in momentum, strength, and direction of a trend in an asset’s price. MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result is then plotted on a chart as a line graph, with a 9-period EMA overlaid as a signal line.

How Does MACD Work?

The MACD indicator consists of three components: the MACD line, the signal line, and the histogram. The MACD line is the difference between the 12-period EMA and the 26-period EMA. The signal line is a 9-period EMA of the MACD line. The histogram is the difference between the MACD line and the signal line.

MACD can be used to identify trend reversals, momentum changes, and potential buy or sell signals. When the MACD line crosses above the signal line, it is considered a bullish signal, indicating that the asset’s price may be trending upward. Conversely, when the MACD line crosses below the signal line, it is considered a bearish signal, indicating that the asset’s price may be trending downward.

How to Use MACD in Trading

Now that you know what MACD is and how it works, let’s take a look at how you can use it in your trading strategy.

1. Identify Trend Reversals

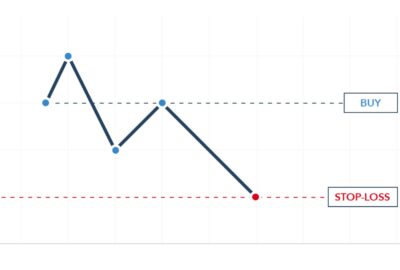

One of the most common ways to use MACD is to identify trend reversals. When the MACD line crosses above the signal line, it is a bullish signal, indicating that the asset’s price may be about to reverse its downward trend. Conversely, when the MACD line crosses below the signal line, it is a bearish signal, indicating that the asset’s price may be about to reverse its upward trend.

2. Confirm Trends

MACD can also be used to confirm the strength and direction of a trend. When the MACD line is above the signal line, it is a bullish signal, indicating that the asset’s price is trending upward. Conversely, when the MACD line is below the signal line, it is a bearish signal, indicating that the asset’s price is trending downward.

3. Identify Potential Buy and Sell Signals

Another way to use MACD is to identify potential buy and sell signals. When the MACD line crosses above the signal line, it is considered a bullish signal, indicating that it may be a good time to buy the asset. Conversely, when the MACD line crosses below the signal line, it is considered a bearish signal, indicating that it may be a good time to sell the asset.

4. Use MACD with Other Indicators

MACD is often used in conjunction with other technical analysis indicators to confirm signals and improve trading decisions. For example, traders may use MACD along with Relative Strength Index (RSI) to identify overbought or oversold conditions.

Tips for Using MACD

Here are some tips to help you use MACD effectively in your trading strategy:

- Use MACD in conjunction with other technical analysis indicators to confirm signals and improve trading decisions.

- Use MACD in combination with price action analysis to increase accuracy and avoid false signals.

- Be aware that MACD is a lagging indicator, which means that it may not provide timely signals in fast-moving markets.

- Adjust the settings of the indicator to suit your trading style and the asset you are trading.

The MACD indicator is a powerful tool that can help traders and investors make better trading decisions. By identifying trend reversals, confirming trends, and identifying potential buy and sell signals, MACD can be a valuable addition to your trading strategy. However, it’s important to remember that MACD is just one tool in your trading arsenal and should be used in conjunction with other technical analysis indicators and fundamental analysis to make informed decisions.

FAQs

- Can MACD be used on any asset? Yes, MACD can be used on any asset that has a price chart.

- How often should I adjust the settings of MACD? The settings of MACD can be adjusted based on your trading style and the asset you are trading. It’s important to experiment with different settings to find the ones that work best for you.

- Can MACD be used for day trading? Yes, MACD can be used for day trading, but it’s important to combine it with other technical analysis indicators and price action analysis to increase accuracy.

- Is MACD a reliable indicator? MACD is a popular and widely used indicator, but it’s important to remember that no indicator is perfect. Traders should use MACD in conjunction with other technical analysis indicators and fundamental analysis to make informed decisions.

- Is MACD a leading or lagging indicator? MACD is a lagging indicator, which means that it may not provide timely signals in fast-moving markets.