The Difference Between A Buy Limit And A Buy Stop Order

Investing in the stock market can be a daunting experience for newcomers. The variety of order types can be confusing, particularly when it comes to buy limit and buy stop orders. Both of these orders are commonly used in trading, but understanding the difference between them is crucial for effective investing.

What is a Buy Limit Order?

A buy limit order is a type of order that instructs the broker to purchase a stock at or below a specific price. This order is used to ensure that the investor only buys the stock at a predetermined price, which is below the current market price.

How Does a Buy Limit Order Work?

For example, suppose an investor wants to buy 100 shares of XYZ stock at $50 per share. The current market price for XYZ stock is $60 per share, but the investor expects the price to decrease. To execute a buy limit order, the investor instructs their broker to purchase the shares only if they are available at or below $50 per share.

Once the price drops to $50 or below, the broker will purchase the stock for the investor. If the price does not drop to $50 or below, the order will not be executed, and the investor will not buy the stock.

Advantages of a Buy Limit Order

When it comes to buying stocks, using a buy limit order can offer several advantages to investors. Here are four key benefits to consider:

- Control over the purchase price: One of the primary advantages of using a buy limit order is that it allows investors to set a maximum purchase price for a stock. This means that if the stock’s price rises above the specified limit, the order will not be executed. By having this level of control, investors can avoid overpaying for a stock and potentially increase their returns.

- Protection against rapid price increases: Another advantage of using a buy limit order is that it can protect investors from overpaying due to sudden price spikes. If a stock’s price rises rapidly, a market order (which is executed at the current market price) could result in the investor paying a much higher price than they intended. With a buy limit order, however, the investor is protected against this scenario. If the stock’s price rises above their specified limit, the order will not be executed, helping to ensure that the investor does not overpay.

- Avoidance of emotion-based trading: Buy limit orders can also help investors avoid making emotional decisions based on short-term market fluctuations. By setting a limit for the purchase price, investors can avoid the temptation to make impulsive trades based on momentary market movements.

- Increased flexibility: Finally, using a buy limit order can provide investors with increased flexibility. By setting a specific purchase price, investors can take advantage of price dips in the market and potentially purchase a stock at a lower price. Additionally, investors can set buy limit orders outside of normal trading hours, allowing them to take advantage of market movements even when the market is closed.

Disadvantages of a Buy Limit Order

The main disadvantage of a buy limit order is that there is no guarantee that the stock will be purchased. If the price never drops to the specified limit, the investor will miss out on the opportunity to buy the stock. Additionally, if the stock price drops and then rapidly rises again, the investor may miss out on the opportunity to buy the stock at a lower price.

What is a Buy Stop Order?

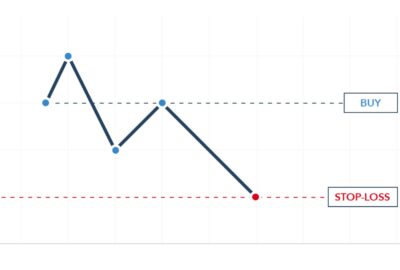

A buy stop order is a type of order that instructs the broker to purchase a stock at or above a specific price. This order is used to ensure that the investor only buys the stock at a predetermined price, which is above the current market price.

How Does a Buy Stop Order Work?

For example, suppose an investor wants to buy 100 shares of XYZ stock at $70 per share. The current market price for XYZ stock is $60 per share, but the investor expects the price to increase. To execute a buy stop order, the investor instructs their broker to purchase the shares only if they are available at or above $70 per share.

Once the price reaches $70 or above, the broker will purchase the stock for the investor. If the price never reaches $70 or above, the order will not be executed, and the investor will not buy the stock.

Advantages of a Buy Stop Order

One of the primary benefits of a buy stop order is that it allows the investor to buy a stock at a specific price. This means that the investor can avoid paying more than they want for the stock, which is particularly useful when the stock is experiencing a temporary rise in price. Additionally, a buy stop order can be used to set a price ceiling on the stock, which can be helpful in limiting potential losses.

Disadvantages of a Buy Stop Order

The main disadvantage of a buy stop order is that there is no guarantee that the stock will be purchased. If the price never reaches the specified stop price, the investor will miss out on the opportunity to buy the stock. Additionally, if the stock price rises and then rapidly falls again, the investor may miss out on the opportunity to buy the stock at a lower price.

Key Differences between Buy Limit and Buy Stop Orders

The primary difference between buy limit and buy stop orders is the specific price at which the stock is purchased. Buy limit orders are executed at or below the specified price, while buy stop orders are executed at or above the specified price. Buy limit orders are generally used to buy a stock at a lower price, while buy stop orders are generally used to buy a stock at a higher price.

Which Order Should You Use?

The type of order that an investor should use depends on their investment strategy and the current market conditions. If an investor wants to buy a stock at a lower price, a buy limit order may be the better choice. If an investor wants to buy a stock at a higher price, a buy stop order may be the better choice. It’s important to note that both types of orders have their advantages and disadvantages, and investors should consider their risk tolerance and investment goals before deciding which order to use.