The Importance Of Position Sizing In Trading

If you are a trader or investor, you have likely heard the phrase “position sizing” before. Position sizing is a crucial concept in trading, and it refers to the amount of capital you allocate to a particular trade. In this article, we will explore the importance of position sizing in trading and provide you with some tips on how to effectively manage your positions.

What is Position Sizing?

Position sizing is a risk management technique that involves determining the optimal amount of capital to allocate to a particular trade. The goal of position sizing is to minimize risk and maximize returns. The position size is determined based on factors such as the trader’s risk tolerance, account size, and the specific trade’s risk-reward ratio.

The Importance of Position Sizing

Effective position sizing can make the difference between a profitable and losing trading strategy. Position sizing ensures that you do not risk too much of your capital on a single trade, which can lead to significant losses if the trade goes against you. Proper position sizing also enables you to take advantage of profitable opportunities by allocating the right amount of capital to each trade.

Types of Position Sizing Strategies

There are several position sizing strategies that traders can employ. Here are a few examples:

· Fixed Position Sizing

Fixed position sizing involves allocating a fixed percentage of your trading capital to each trade. For example, you may decide to risk 2% of your account capital on each trade. This strategy ensures that your risk is limited, but it may also limit your upside potential.

· Variable Position Sizing

Variable position sizing involves adjusting the position size based on the specific trade’s risk-reward ratio. For example, you may decide to risk 2% of your account capital on a trade with a 1:2 risk-reward ratio and 1% of your account capital on a trade with a 1:1 risk-reward ratio. This strategy enables you to take advantage of profitable opportunities while limiting your risk.

· Kelly Criterion Position Sizing

The Kelly Criterion is a position sizing strategy that takes into account the probability of a trade’s success. It involves allocating a percentage of your account capital based on the trade’s expected return and probability of success. This strategy can be complex to implement, but it can be highly effective when used correctly.

Tips for Effective Position Sizing

Here are a few tips to help you effectively manage your positions:

1. Determine Your Risk Tolerance

Before you start trading, it’s essential to determine your risk tolerance. Your risk tolerance will help you determine the appropriate position size for each trade. If you have a low risk tolerance, you may want to consider a fixed position sizing strategy. If you have a higher risk tolerance, you may want to consider a variable or Kelly Criterion position sizing strategy.

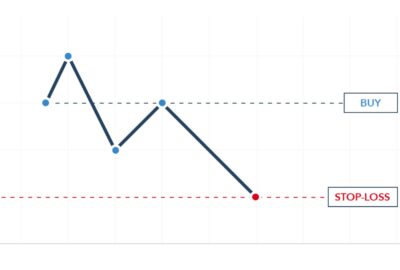

2. Use Stop-Loss Orders

Stop-loss orders are an essential tool for managing risk in trading. A stop-loss order automatically closes out a trade if it reaches a certain price level, limiting your potential losses. You can use stop-loss orders in conjunction with your position sizing strategy to ensure that your risk is limited.

3. Monitor Your Positions

It’s essential to monitor your positions regularly to ensure that they are performing as expected. If a position is not performing as expected, you may want to consider closing it out to limit your losses.

Position sizing is a crucial concept in trading that enables traders to manage risk and maximize returns. Effective position sizing involves determining the optimal amount of capital to allocate to a particular trade based on factors such as the trader’s risk tolerance, account size, and the specific trade’s risk-reward ratio. By using the tips outlined in this article, you can effectively manage your positions and improve your trading results.

Frequently Asked Questions

- What is position sizing?

Position sizing is a risk management technique that involves determining the optimal amount of capital to allocate to a particular trade based on various factors such as risk tolerance, account size, and the specific trade’s risk-reward ratio.

- Why is position sizing important?

Effective position sizing is essential in trading as it ensures that you do not risk too much of your capital on a single trade, which can lead to significant losses if the trade goes against you. It also enables you to take advantage of profitable opportunities by allocating the right amount of capital to each trade.

- What are the different types of position sizing strategies?

There are various position sizing strategies that traders can use, including fixed position sizing, variable position sizing, and Kelly Criterion position sizing.

- What is a stop-loss order, and why is it important?

A stop-loss order is an essential tool for managing risk in trading. It automatically closes out a trade if it reaches a certain price level, limiting your potential losses. Using a stop-loss order in conjunction with your position sizing strategy can help ensure that your risk is limited.

- How can I determine my risk tolerance?

Your risk tolerance is a personal decision that depends on various factors such as your financial situation, investment goals, and personality. You can determine your risk tolerance by assessing your financial goals, investment experience, and willingness to accept risk. It’s essential to choose a position sizing strategy that aligns with your risk tolerance.